Information disclosure based on TCFD Proposal

The Company has been providing a consistent supply of products and services to meet the needs of the times as an electronics technology trading company dealing in electronics and electrical equipment and electronics components that use cutting-edge technologies and as a chemicals manufacturer producing environmentally friendly industrial chemicals. With an awareness that climate change and other sustainability issues are priority issues that the Company should increase its efforts to address through its corporate activities, the Company expressed its support for the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.*1 The Company will continue to promote the disclosure of climate change-related information and contribute to creating a sustainable society.

- *1The TCFD was established by the Financial Stability Board in 2015 in response to a request from the G20. The TCFD recommends businesses to evaluate the financial impact that climate-related risks and opportunities have on their management and disclose matters on governance, strategy, risk management, metrics and targets. (TCFD website : https://www.fsb-tcfd.org/)

1. Governance

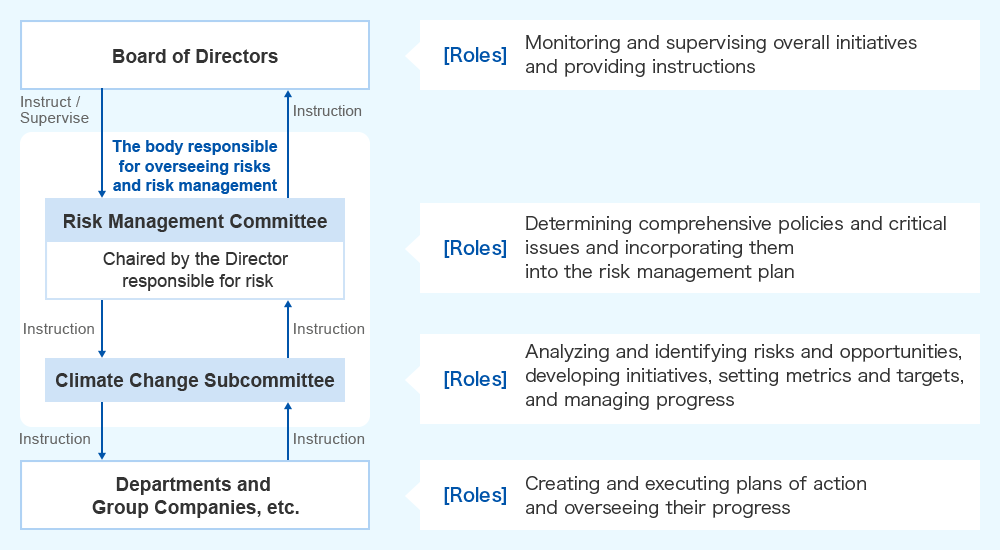

The Company will form a Climate Change Subcommittee under the Risk Management Committee*2. The subcommittee will analyze and identify risks and opportunities related to climate change issues. The subcommittee will also develop initiatives, set metrics and targets, and manage progress in implementing the initiatives.

The Climate Change Subcommittee will monitor and manage plans and progress in their implementation at all departments and Hakuto Group companies, among other entities, which take concrete measures. The subcommittee will report to the Risk Management Committee, which is chaired by the Director responsible for risk. The committee will hold four meetings annually.

The Board of Directors will monitor and supervise overall initiatives and provide instructions based on the reports from the Risk Management Committee.

- *2The committee responsible for overseeing risk management within the Group

2. Strategy

The Company has performed a series of scenario analyses for the short term (up to 2025), medium term (up to 2030), and long term (up to 2050) to assess the impact of climate change risks and opportunities on its major business operations in Japan.

During the scenario analyses, the Company has referred to socio-economic scenarios, particularly those assuming a 1.5℃ and a 4℃ increase in average temperature. The analyses considered changes resulting from the transition to a low-carbon economy*3 and physical changes caused by climate change*4. Based on the analyses, the Company has identified potential risks and opportunities and examined the countermeasures that it can take.

In the analysis process, the Company interviewed personnel in each department and qualitatively assessed risks and opportunities in about 60 socio-economic scenarios. The risks and opportunities were categorized into minor, medium, and major.

The Company assessed transition risks and opportunities based on the 1.5℃ scenario and assessed physical risks and opportunities on the 4℃ scenario. The main risks and opportunities that may have a medium or major impact on the Company’s management and business in the medium to long term (up to 2030 and 2050, respectively) are as described below.

- *3Changes in policies, laws and regulations, and requests to markets and companies for a transition to a low-carbon economy

- *4Acute natural phenomena (droughts, increasing storms and floods, etc.) and chronic phenomena (average temperature increases, sea level rises, etc.) caused by climate change

| Transition | 1.5℃ scenario:IEA "Net Zero Emissions by 2050 Scenario(NZE)"

|

|---|---|

| Physical | 4℃ scenario: IPCC "RCP8.5" |

| Socioeconomic Scenario | Risks and Opportunities | Proposed Solution | ||

|---|---|---|---|---|

| Transition | Policy, law | Application of carbon tax |

[Risk]

|

|

|

[Risk]

|

||||

| Reduction in GHG emissions from facilities and equipment |

[Opportunities]

|

|

||

| Requests for reducing carbon emissions, power-saving, and space-saving |

[Opportunities]

|

|

||

| Technology | Popularization of EVs and FCVs |

[Opportunities]

|

|

|

| Market | Reduction in existing transactions related to petroleum refineries |

[Risk]

[Opportunities]

|

|

|

| Reputation | Mitigation of climate change |

[Risk]

[Opportunities]

|

|

|

| Physical | Acute | Droughts |

[Risk]

|

|

| Increasing frequency and severity of storms and floods |

[Risk]

[Opportunities]

|

|

||

3. Risk Management

The Climate Change Subcommittee will analyze and identify risks and opportunities associated with climate change and will then report its findings to the Risk Management Committee.

The Risk Management Committee will review the reports to determine the order of priority and integrate the identified risks and opportunities into the risk management plan*5. Additionally, the committee will report the status of risk management to the Board of Directors and make recommendations.

- *5A plan for handling and monitoring major risk events that management should manage

4. Metrics and Targets

The Company considers climate change to be the most significant environmental concern. The Company will set quantitative greenhouse gas (CO2) emissions reduction goals aligned with the 1.5℃ Paris Agreement target and take action to reduce emissions.

The Company’s actual GHG emissions are as shown below.

| Items | FY2021 | FY2022 (tentative) |

|---|---|---|

| Scope1 | 580.65 t-CO2 | 555.6 t-CO2 |

| Scope2 | 612.68 t-CO2 | 554.5 t-CO2 |

| Scope3 | ― | ― |